Nanoveu’s Insider-Led Placement Signals Confidence Amid Commercialisation Risks

Nanoveu Limited has expanded its capital raise to $2.7 million, led by a significant investment from CEO Mark Goranson and strong insider participation, to accelerate development across its semiconductor, 3D visualisation, and solar technology divisions.

- Placement increased to $2.7 million with $410,000 additional insider commitments

- CEO Mark Goranson to invest $350,000 as cornerstone participant

- Directors and management contributing $810,000 total, signaling strong confidence

- Shares priced at $0.031 with 1-for-2 free attaching options exercisable at $0.045

- Funds directed to EMASS semiconductors, EyeFly3D™ platform, and Nanoshield™ Solar trials

Nanoveu Strengthens Capital Raise with Executive Backing

Nanoveu Limited (ASX: NVU) has announced an upsizing of its recent placement to raise a total of $2.7 million, buoyed by an additional $410,000 in firm commitments from its executive team. Notably, Mark Goranson, CEO of Nanoveu’s Semiconductor Technologies division, is set to invest $350,000, positioning himself as a cornerstone investor in the expanded placement.

This move brings the total contribution from directors and management to $810,000, underscoring a strong internal conviction in the company’s strategic direction and technology portfolio. The placement shares are priced at $0.031 each, accompanied by a 1-for-2 free attaching option exercisable at $0.045 within two years, offering investors additional upside potential.

Funding Focused on High-Growth Technology Divisions

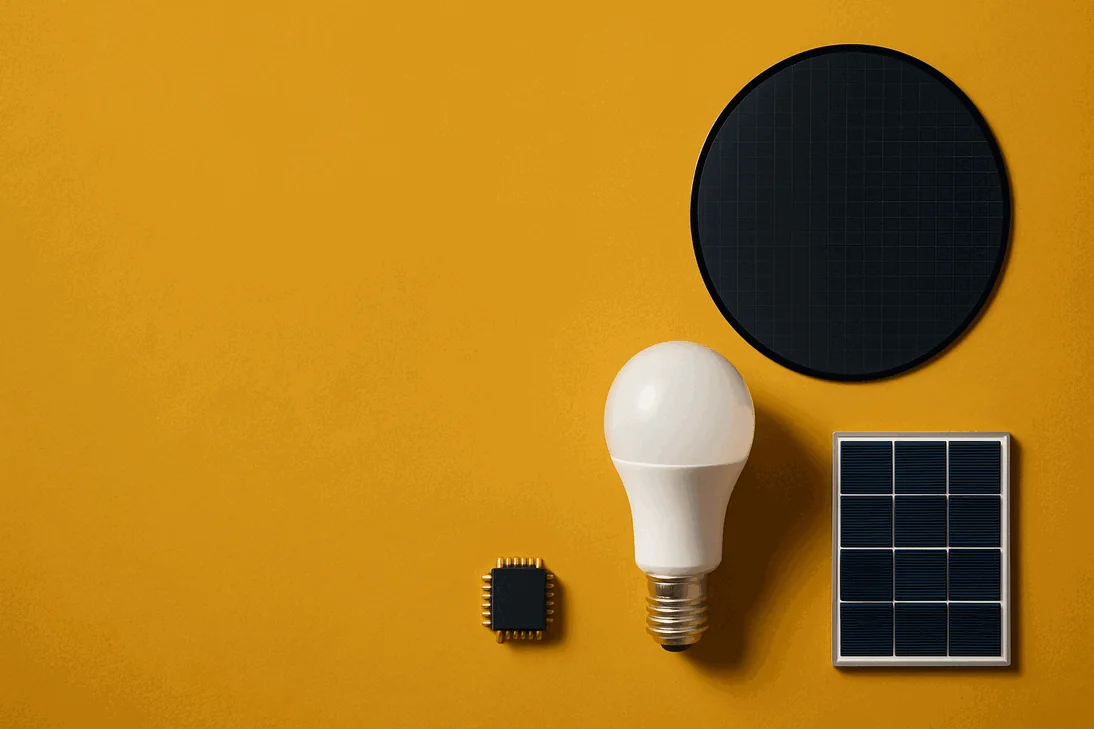

The capital raised will be deployed to accelerate the development and commercialisation of Nanoveu’s core technologies: the EMASS ultra-low-power edge AI semiconductor platform, the EyeFly3D™ glasses-free 3D visualisation system, and the Nanoshield™ Solar coatings currently undergoing field trials in Morocco and the UAE.

EMASS continues to attract attention for its energy efficiency, boasting performance benchmarks up to 287 times greater than existing systems. EyeFly3D™ is gaining commercial traction with initial orders and a multi-year agreement with Rahum Nano Tech. Meanwhile, Nanoshield™ Solar aims to enhance solar panel efficiency by reducing soiling, a critical factor in renewable energy adoption.

Strategic Implications and Market Positioning

Executive Chairman Dr David Pevcic highlighted the significance of the insider participation, stating it reflects management’s confidence in Nanoveu’s technology and commercial prospects. The placement will be completed within existing ASX placement capacities, with director subscriptions subject to shareholder approval expected in July 2025.

Joint lead managers Evolution Capital and 62 Capital are overseeing the placement, which includes a fee structure aligned with the capital raised. The company’s strategic outlook points to leveraging this funding to engage partners and expand commercial activities across edge computing, 3D content, and renewable energy markets.

As Nanoveu advances its commercialisation roadmap, the market will be watching closely for the outcomes of ongoing field trials and the company’s ability to convert technological promise into tangible revenue streams.

Bottom Line?

Nanoveu’s strong insider backing and expanded capital raise set the stage for a pivotal phase in commercialising its cutting-edge technologies.

Questions in the middle?

- Will shareholder approval for director share issuance proceed smoothly?

- How soon can Nanoveu translate its technology benchmarks into commercial contracts?

- What impact will Nanoshield™ Solar field trials have on market adoption in renewable energy?